The Psychology of Money: Overcoming Financial Fears at Midlife

Midlife is often described as a time of reflection, transformation, and recalibration. As careers stabilize and children leave the nest, many people begin reassessing their life goals and long-term financial plans. Yet for all its potential, this stage of life often brings with it a heavy emotional weight—especially where money is concerned.

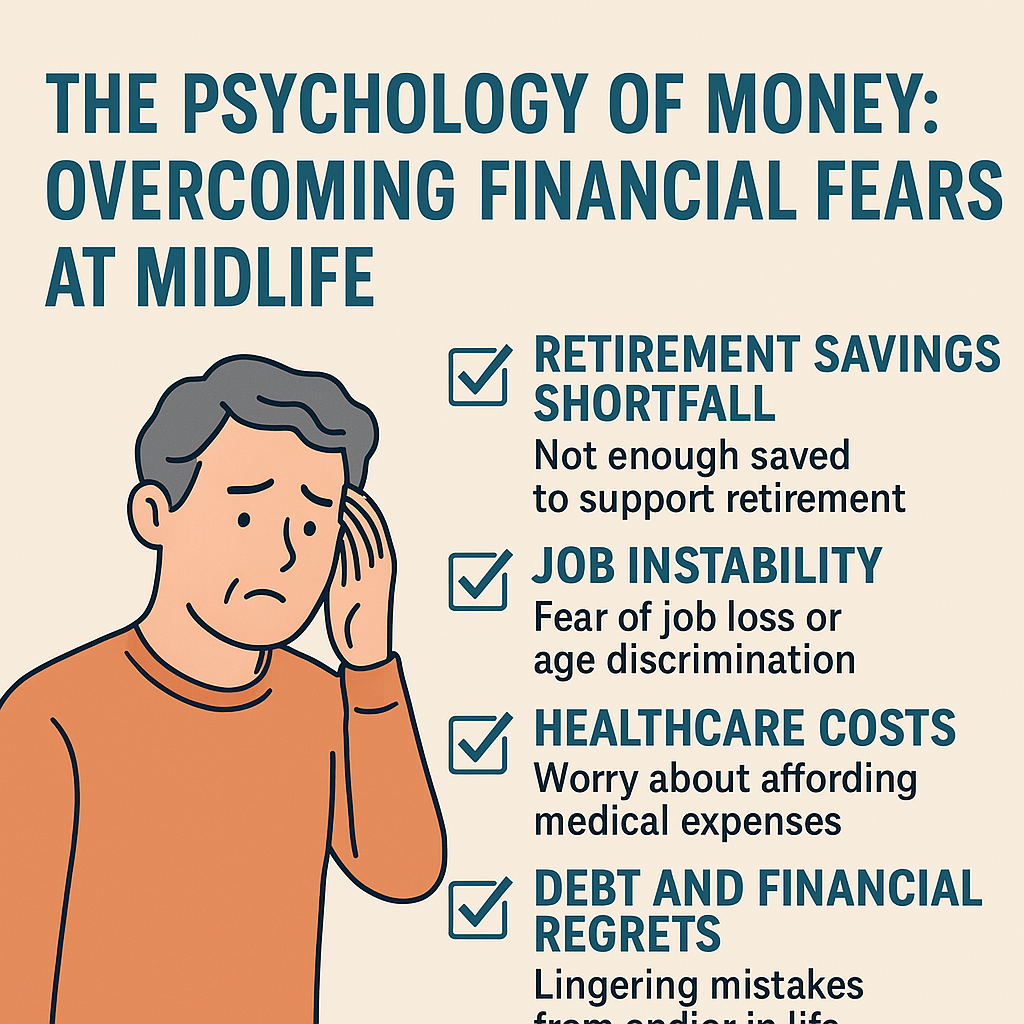

Whether it’s a fear of not saving enough for retirement, anxiety about health expenses, or regrets about past financial decisions, money psychology at midlife can have a profound impact on well-being. But it’s not all doom and gloom. With the right mindset, tools, and strategies, it is entirely possible to overcome financial fears, take control, and build a secure and fulfilling future.

Understanding the Psychology Behind Financial Anxiety

Money is rarely just about numbers. It’s deeply tied to our sense of security, self-worth, identity, and even morality. According to behavioral finance experts, people form emotional attachments to money based on early childhood experiences, cultural influences, and personal history.

Common Financial Fears at Midlife:

- Running out of money in retirement

- Having to work forever

- Not affording healthcare in old age

- Being a burden to children

- Facing job instability or ageism

- Not leaving a legacy or inheritance

These fears can lead to analysis paralysis, chronic stress, and even avoidance of necessary financial decisions—ironically worsening the very outcomes we’re trying to prevent.

Why Midlife Triggers Financial Introspection

The 40s and 50s represent a unique financial pressure cooker. You may still be paying off a mortgage or supporting adult children, all while trying to turbocharge retirement savings. At the same time, you’re more acutely aware of your mortality and may be noticing physical or cognitive changes that shift your financial goals.

Key Life Events That Amplify Financial Stress:

- Divorce or remarriage

- Career transition or job loss

- Caring for aging parents

- Sending kids to college

- Major health diagnosis

Each of these experiences can spark deep-rooted questions about worth, priorities, and security.

Step-by-Step Strategies to Overcome Financial Fears

1. Acknowledge the Emotions

Start by identifying your specific fear: Is it a vague anxiety or a concrete worry? Don’t dismiss your concerns—explore them. Talk to a partner, therapist, or financial coach. Naming your fear is the first step toward dismantling it.

Tip: Keep a journal of money-related thoughts for one week. Patterns will emerge that help you pinpoint underlying beliefs.

2. Reframe the Narrative

Financial fears are often driven by limiting beliefs, such as “I’m bad with money” or “It’s too late to change.” Reframing these thoughts from a place of growth and agency can open doors.

Replace:

- “I’ll never retire”

With: - “I can adjust my lifestyle and create a flexible retirement plan.”

3. Create a Midlife Financial Check-Up

Knowledge is power. Instead of avoiding the truth, assess where you really stand:

- Calculate your net worth

- Review retirement account balances

- Estimate healthcare costs

- Track monthly spending

- Review credit scores

This exercise can reduce anxiety simply by replacing uncertainty with clarity.

4. Set Realistic and Personalized Goals

Forget the one-size-fits-all advice. A good financial plan reflects your values and lifestyle. Perhaps you’ll downsize, relocate, start a side business, or choose phased retirement. There’s no universal rulebook.

SMART Goals Example:

- “Save an additional $500/month in my IRA for the next 10 years.”

- “Pay off my car loan in 18 months.”

5. Work with a Fee-Only Financial Advisor or Coach

A professional can help you develop a strategy that’s data-driven and emotionally supportive. Look for fiduciary advisors who have your best interests at heart, not someone selling products.

Benefits of Professional Help:

- Removes emotion from decision-making

- Provides accountability

- Uncovers blind spots in your planning

6. Practice Financial Mindfulness

Just as meditation helps with anxiety, financial mindfulness helps with money stress. This practice includes:

- Checking bank accounts without panic

- Reviewing expenses without guilt

- Celebrating small financial wins

- Letting go of perfectionism

Mindful money habits can rebuild your confidence.

7. Declutter and Automate

Simplicity leads to peace of mind. Streamline your finances by:

- Consolidating retirement accounts

- Using budgeting apps

- Automating bill payments and savings

- Setting calendar reminders for financial tasks

When your money system runs efficiently, you gain mental space to focus on long-term goals.

8. Address Health and Insurance Early

Health is closely tied to financial security at midlife. Avoid the common trap of postponing care or ignoring insurance options.

To Do:

- Schedule annual physicals and screenings

- Review life, disability, and long-term care insurance

- Understand your Medicare options (if approaching 65)

Peace of mind is a critical financial asset.

The Role of Legacy and Purpose

Midlife is also a time when we begin thinking about what we leave behind—not just money, but impact. Shifting your financial mindset from scarcity to purpose can be powerful.

Questions to reflect on:

- What legacy do I want to leave?

- How can I use money as a tool for meaning?

- Do I want to support a cause, create experiences, or invest in relationships?

Common Financial Traps to Avoid

Even with the best intentions, midlife savers can fall into these traps:

- Lifestyle inflation: Earning more and spending more instead of saving more

- Tapping retirement savings early: Avoid this unless it’s a true emergency

- Ignoring estate planning: Wills, healthcare directives, and power of attorney are essential

- Falling for “get rich quick” schemes: Be wary of too-good-to-be-true opportunities

FAQs: Overcoming Financial Fears at Midlife

Q: Is it too late to start saving for retirement in my 50s?

A: No. While starting earlier helps, many people save aggressively in their 50s and adjust their retirement age or lifestyle to meet their goals.

Q: How can I stop feeling guilty about past financial mistakes?

A: Recognize that mistakes are learning opportunities. Forgive yourself, reflect on lessons learned, and focus on the actions you can take now.

Q: What’s the best way to talk about money with a spouse or partner?

A: Choose a calm time, use “we” language, and focus on shared goals. Consider using a financial coach to facilitate if conversations are difficult.

Q: How much should I have saved by age 50?

A: This varies widely. A general rule is to have 5–6 times your annual salary saved, but more important is understanding your target retirement lifestyle.

Q: Can therapy help with financial anxiety?

A: Yes. Therapists trained in financial or behavioral therapy can help unpack emotional money beliefs and develop healthier coping mechanisms.